Iowa Withholding Tables 2025. The 2025 tax year standard deduction for single taxpayers is $14,600 — a $750 increase from 2025 when the standard deduction was $13,850. The income tax rates and personal allowances in iowa are updated annually with new tax tables published for.

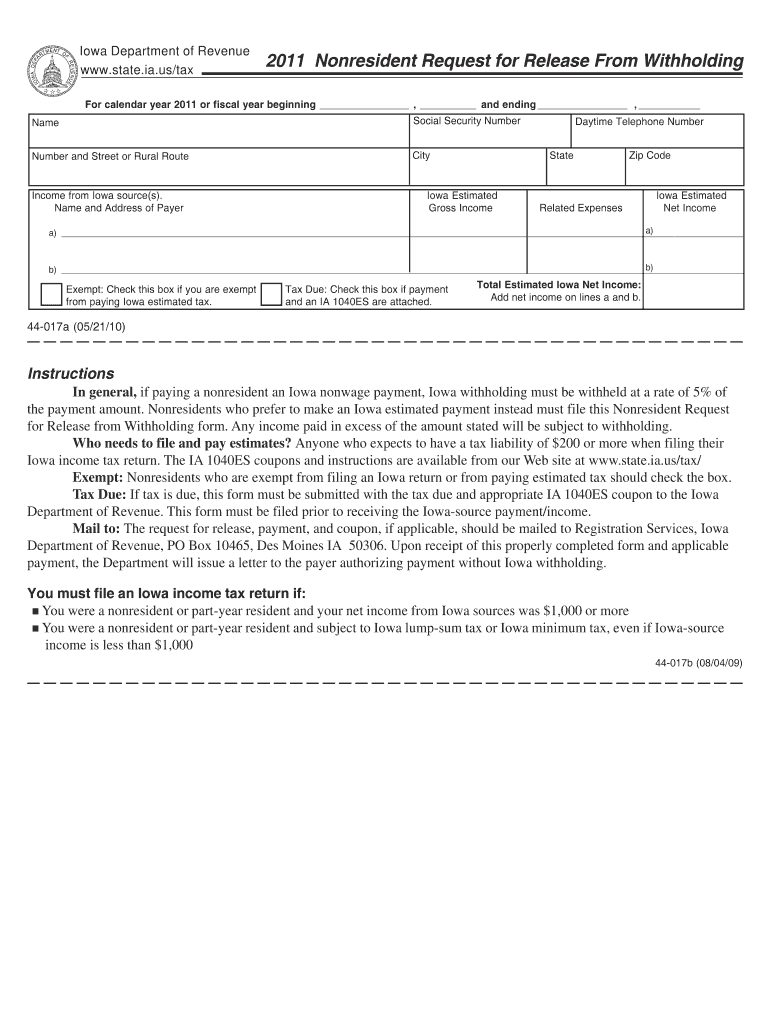

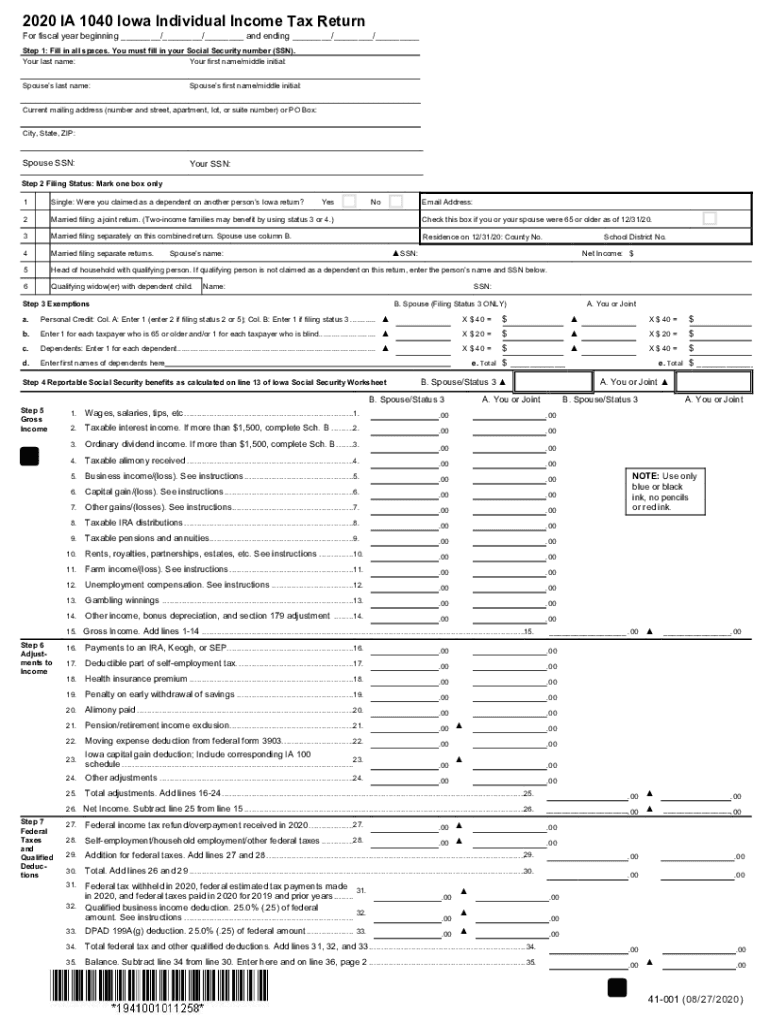

Instruction for iowa withholding tables. 1040instructions step1 6 step2 7 step3 8 step4 9 step5 13 step6 47 step7 57 step8 59 step9 62 otherinformation newfor2023 3.

1040instructions step1 6 step2 7 step3 8 step4 9 step5 13 step6 47 step7 57 step8 59 step9 62 otherinformation newfor2023 3.

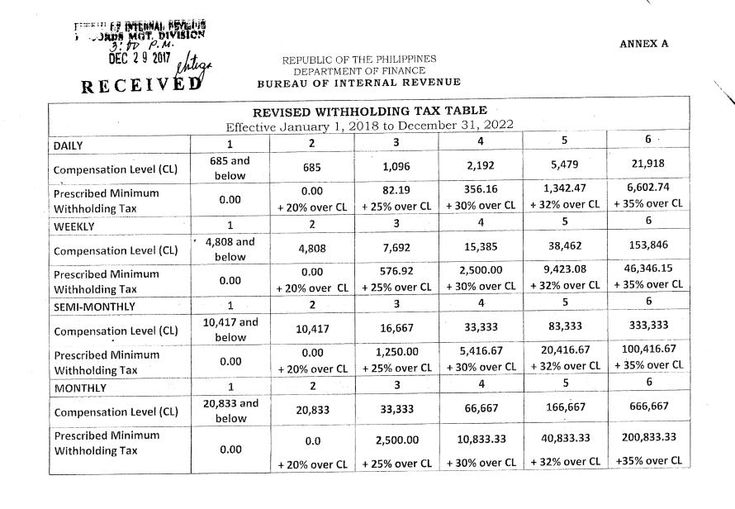

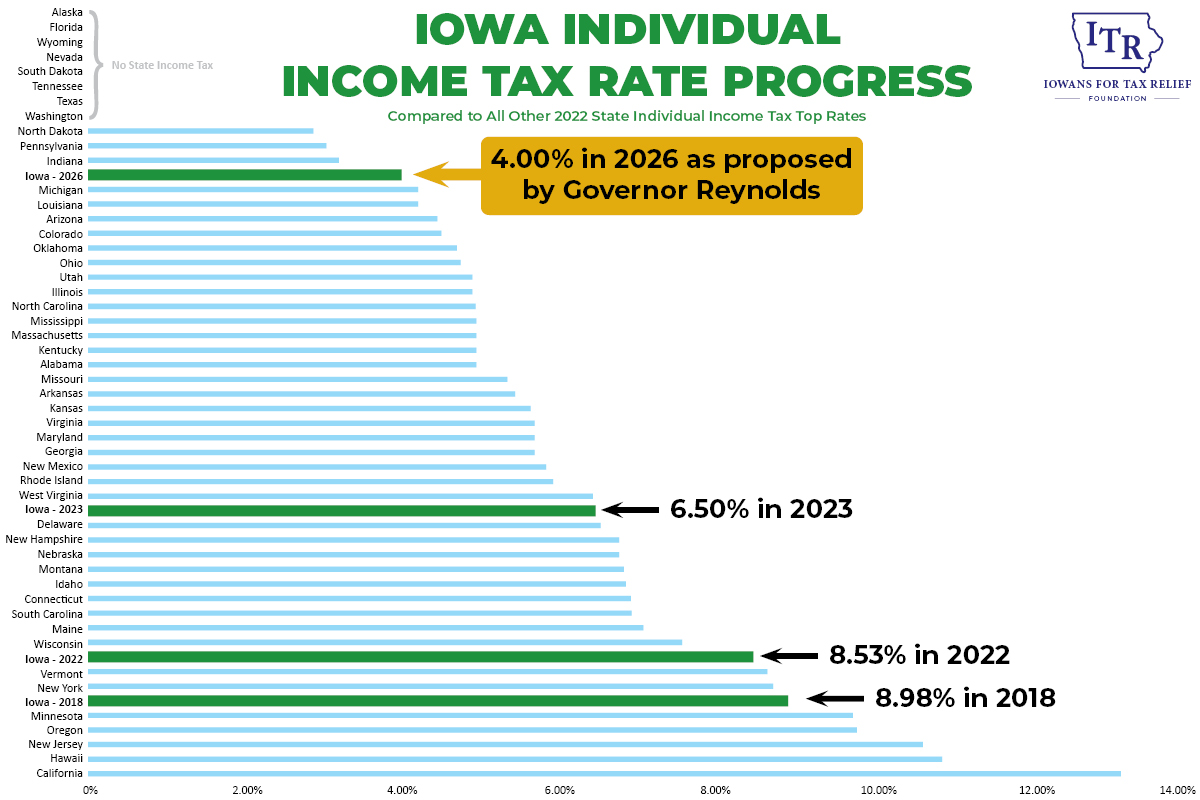

Iowa Tax Changes Effective January 1, 2025 ITR Foundation, The iowa department of revenue is issuing updated income tax withholding formulas and tables for 2025. Use these updated tables to.

Ia 1040es 20192024 Form Fill Out and Sign Printable PDF Template, Just unit (1 allowance = $40, 2. The iowa department of revenue is issuing updated income tax withholding formulas and tables for 2025.

Iowa Tax Withholding Form, The irs has released the 2025 tax brackets, along with updated income tax withholding tables for employers. The department updates withholding formulas and tables when necessary to account for inflation and for changes in.

Tax rates for the 2025 year of assessment Just One Lap, Find your pretax deductions, including 401k,. The irs has released the 2025 tax brackets, along with updated income tax withholding tables for employers.

New Iowa Flat Tax Law Impact on Retirees Arnold Mote Wealth Management, The irs has released the 2025 tax brackets, along with updated income tax withholding tables for employers. The iowa department of revenue is issuing updated income tax withholding formulas and tables for 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Changes to 2025 withholding tax: The number of allowances claimed.

Governor’s Tax Plan By The Numbers Iowans for Tax Relief, The number of allowances claimed. Find your pretax deductions, including 401k,.

Tax Withholding Tables For Employers Elcho Table, Just unit (1 allowance = $40, 2. Iowa state income tax tables in 2025.

Iowa 1040 20202024 Form Fill Out and Sign Printable PDF Template, This is the actual federal withholding. The 2025 tax year standard deduction for single taxpayers is $14,600 — a $750 increase from 2025 when the standard deduction was $13,850.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

How to Fill out Form W4 in 2025 (2025), Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Iowa 2025 tax withholding tables beginning january 1, 2025.

Employees and payees may now use the irs tax withholding estimator, available at irs.gov/w4app, when.